No two zebras have the same stripes

No two humans have the same fingerprint

No two individuals have the same needs

Wealth Solutions Tailored To Your Needs

Platinum Club RIAdvice Practice of the Year Awarded in 2023

No two zebras have the same stripes

No two humans have the same fingerprint

No two individuals have the same needs

Wealth Solutions Tailored To Your Needs

WELCOME TO ZEBRA TAILORED WEALTH

At Zebra Tailored Wealth, our goal is to work with you along the way on life’s journey. As such, our approach to financial advice and wealth management starts with getting to know you.

We want to learn about you and your family, your current situation, the plans and goals you have for the future, as well as spending time discussing the values you believe in and the concerns you have. Only then can we begin to tailor a solution to meet your unique needs.

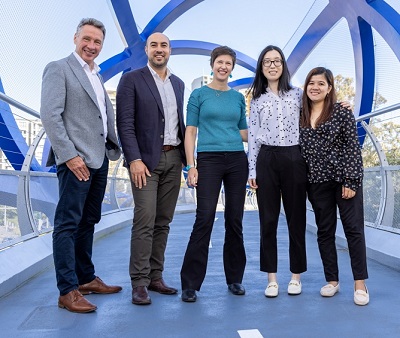

WHO ARE ZEBRA TAILORED WEALTH

Alysia, Scott and Ross are a team of highly qualified and passionate financial advisers that have almost 50 years experience between them. We share the common values of seeking to provide exceptional service and treating our clients as individuals so that we can tailor our advice to their unique needs.

Zebra Tailored Wealth is privately owned by the principal advisers which means our reputation is important to us. We have elected to use the licensee services of RI Advice, which is part of Rhombus Advisory, as this gives us the ability to provide the service of a small personal company, with the back office and investment support of a large financial services organisation.

WHY YOU SHOULD CHOOSE ZEBRA TAILORED WEALTH

Whether we are evaluating the best strategies to use, ensuring that everything is done in a timely manner, staying on top of legislative changes that may impact or create opportunities for you, following investment markets and making appropriate adjustments to your portfolio, or reviewing your insurances and estate planning, we can take care of it all, which gives you more time to focus on what you really enjoy doing with your life.

Our three highly qualified principal advisers have almost 50 years of advice experience between them. This experience is essential in advice as it equips us with the skills necessary to be able to provide genuine holistic advice tailored to our client’s individual needs. Our experience also helps us identify and explain better ways of doing things, while addressing potential issues before they become problems.

In an industry where we are increasingly seeing private advice firms building and recommending their own in-house investment models which they derive a revenue from, Zebra Tailored Wealth continues to see the importance of recognising that no two individuals have the same needs, and the importance of tailoring investment solutions that places our clients needs first. As such we do not receive revenue from any of the investment products or portfolios that we recommend to our clients, which means you can be confident that our advice is based on your needs and preferences, not ours.

In an industry where we are increasingly seeing private advice firms building and recommending their own in-house investment models which they derive a revenue from, Zebra Tailored Wealth continues to see the importance of recognising that no two individuals have the same needs, and the importance of tailoring investment solutions that places our clients needs first. As such we do not receive revenue from any of the investment products or portfolios that we recommend to our clients, which means you can be confident that our advice is based on your needs and preferences, not ours.

So, whether you are the sort of client that would like us to take care of the investment decisions for you, or whether you would prefer us to work collaboratively with you and go through the investment decisions in finer detail, we will listen to what is important to you and tailor our portfolio recommendations to meet your unique needs.

PRIVATELY OWNED WITH INSTITUTIONAL SUPPORT

Zebra Tailored Wealth is a privately owned company that operates under a financial services license from RI Advice, who are a licensee services provider that is part of Rhombus Advisory.

Rhombus Advisory is a large financial services group that licenses approximately 500 self-employed advisers across Australia.

HOW WE WORK WITH RI GROUP AND RHOMBUS ADVISORY

Zebra Tailored Wealth pay Rhombus Advisory for their licensee services which forms the infrastructure of our business, including operational support, compliance systems, technology, and a significant markets, investment and product research function which allows us access to a huge range of investment and insurance solutions for our clients.

Having the support of Rhombus Advisory benefits our clients as it means that we can spend our time focusing on delivering a high level of personalised service, while giving you the confidence that we are supported by the capabilities of a large dedicated financial services organisation that is equally focused on helping our clients manage their wealth and be in a better financial position.

EXTENSIVE INVESTMENT RESEARCH AND CAPABILITY

The Rhombus Advisory investment research team provide us with investment market information, continuous industry leading investment research, as well as access to further in-depth research through companies such as Lonsec. The exceptionally broad range of fully researched investments covers:

- Over 60 different separately managed accounts / discretionary portfolios with various leading investment managers covering single sector, multi-sector, index and active solutions;

- Almost 700 managed funds (including access to more unusual areas such as Private Equity and a range of alternative investment managers);

- Listed investments including direct shares, ETF’s, and hybrids;

Other product solutions that includes annuities and insurance bonds.

Although no individual client needs such an exhaustive range, it does mean that no matter whether you have simple or bespoke needs, that you can be confident that Zebra Tailored Wealth have the skills, support, and extensive range of solutions to work with, that will enable us to tailor a professionally managed investment portfolio solution specifically suited to your needs.

Financial advice and investment management is too complex to set and forget. Our service ensures that not only are you given the best start, but that we can continue to monitor your progress towards your goals. Then, as your circumstances change and investment markets evolve, we can provide you with updated advice across your full financial needs.

HOW WE CAN HELP

Prepare for retirement and beyond

You want to be confident that you will have enough money to enjoy your life when you stop working.

Make the most of retirement

You would like to leave a legacy for your kids and ensure you don’t run out of money anytime soon.

WHAT WE DO

We develop tailored step-by-step financial strategies and help you make informed decisions about your money.

Superannuation

Superannuation is a way to save for your retirement. You build up super while you are working to make sure you can have a comfortable retirement.

Wealth Creation

IIf you’d like your money to start working for you, it’s time to learn about investing. Everyone has different needs and circumstances but here are some basics to consider.

Wealth Management

We want to learn about you and your family, your current situation, the plans and goals you have for the future, as well as spending time discussing the values you believe in.

Wealth Protection

Insurance is the foundation of all financial plans. We can help you evaluate the risks and come up with the right insurance solution for you and your family.

Retirement Planning

Retirement may seem like a long way off but putting money into super now is still a tax effective way to invest your money. You also can benefit from compounding returns.

Debt Management

Effective debt management is not just about the interest you pay, but also the type of assets you’re investing in and prioritising your debts.

Estate Planning

We’d all like to leave a legacy and provide for those closest and dearest to us once we’re gone. Estate Planning ensures your assets are distributed to the right people at the right time.

Aged Care

It’s not easy making the decision to place a loved one into care. Once you’ve made the call, it can be confusing to understand how it all works.